Jobs puts forth some pretty good arguments here for why the iPhone and iPad don’t support Adobe’s Flash. From the driver’s seat (iPhone is at the top-of-the mobile device heap), you can see why Apple doesn’t want Flash holding it back.

Jobs puts forth some pretty good arguments here for why the iPhone and iPad don’t support Adobe’s Flash. From the driver’s seat (iPhone is at the top-of-the mobile device heap), you can see why Apple doesn’t want Flash holding it back.

Month: April 2010

Rewarding Failure

The problem with the Obama administration rewards failure and punishes success.

- When the financial industry failed:

Obama was there to bail them out. - When GM failed:

Obama was there to bail them out. - When homeowners over-extended and failed to pay mortgages: Obama was there to bail them out.

- When Americans failed to find jobs:

Obama bailed them out with extended unemployment.

But what happens to the Americans that managed to succeed and make money rather than lose it? Obama chastises this group as the greedy, evil rich people. And to punish these people for being successful, Obama increases their medicare taxes, increases their income taxes, increases their capital gains taxes, limits their itemized deductions, and even hopes to implement a windfall tax if you’re just too damn successful. That’s 3.8% + 3-4% + 5% + reductions in itemized deductions. So in addition to the over 50% that you already pay in taxes, Obama wants to take another 12.8%!

And don’t forget – the state of California plans to increase taxes too…

Let’s put incentives in for being a benefit to the system rather than benefits for being a drain on the system.

Waiting For A Better Browser

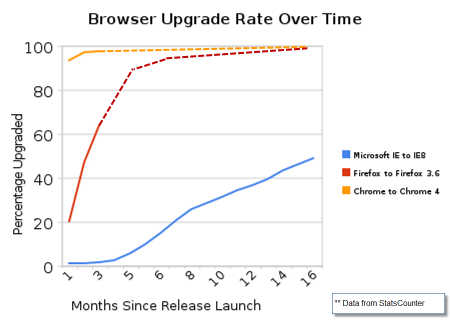

When browser upgrades arrive, they usually contain good improvements in terms of speed, security, reliability, and features. For website developers, new browsers usually offer better capabilities for building websites. Unfortunately, there is a lag-time between when browsers are released with new features and when users upgrade sufficiently that developers can use them.

Upgrades are also important from a security perspective. When users run older browsers they are exposed to security risks which have been previously discovered and potentially fixed. In the case of Internet Explorer, this problem got so bad, that various governments, and even Microsoft advised against users’ continued use of Microsoft Internet Explorer 6.

So how long does it take users to shift to a new browser?

|

Browser |

Upgrade Time |

|

Chrome |

Days |

|

Firefox |

Months |

|

Microsoft IE |

Years |

The data from StatsCounter shows this very clearly. Chrome upgraded virtually all of its users from version 4.0 within a month, starting in Feb 2010. Firefox also upgraded version 3.6 at about that time. The upgrade is progressing quickly, and now, 3 months later, approximately two-thirds of Firefox users have upgraded. Internet Explorer 8, by contrast, was released over a year ago, and so far less than half of IE users have upgraded.

The Tax Man Cometh

It’s April 15th.

The Politician’s Answer

Jerry Brown, the former California Governor and current California Governor hopeful, was on site at Google yesterday. I attended the 1 hour talk where Eric Schmidt played a soft Charlie Rose.

At the end, I asked a softball question myself. And I got a politician’s answer.

I asked, “California taxes – are they too high, too low, or about right?†Brown initially pointed out that during his administration as Governor of California, there were no new taxes (1975-1982). Then he went on to talk for quite a while, and basically said he didn’t think we should raise taxes, but he didn’t think that state financed programs should pay the price of the $11T of wealth lost due to the Wall Street debacle. (He implied that the state’s budget problems are related to that, which is at least partially true)

Sadly, Gov Brown wasn’t completely truthful with me. A quick search through Google reveals an article dated Sept 18, 1981 which proves that Brown did at least increase one tax. I don’t really mind so much that he had a tax increase in 1981. But he was quite emphatic in his reply to my question that he had never raised taxes as Governor. Ok – he embellished.

So, to summarize his politician’s answer: he doesn’t want to raise taxes, and he doesn’t want to cut programs. He didn’t actually answer my question, and in his reply he didn’t stick to just the truth. It wasn’t a horrible lie, and could even be chalked up to a minor mistake. But isn’t this what we expect from politicians these days? Nobody really expects him to just be straightforward anymore.

As for me, I liked Brown’s overall talk. I won’t vote for him, though. We need serious change in California, and the existing bureaucrats have proven they can’t do it. I don’t know if CEOs and business people can do it (obviously actors can’t do it), but Brown loses the vote because he’s been a career politician too long. Is that age discrimination on my part? Ha! Call the EEOC!

Taxes: The Myth of “Deficit Neutral” Spending

Obama likes to say that new spending should be “deficit neutralâ€. That sounds like a great idea! After all, nobody wants to be financially irresponsible, right? The idea that we account for new spending is a good one, and it is better than not accounting for new spending. But, it’s yet another politician’s con job.

Let’s use a simpler example. Let’s say you have a monthly income of $1,000. And let’s say you’re carrying a debt of $100,000 for your mortgage, for which you pay $537 per month. You also tend to spend about $500 on your other living expenses, so all in all you’re losing money each month. Since a tax-hike is like a giving the government a raise, let’s say that one day, you get a raise of $200 per month. You could decide to save that money. Or, you could decide to go buy a car (healthcare) for $20,000 and a $200 per month payment. All-in-all, you convince yourself, you are “deficit neutralâ€.

Here is how it looks:

|

|

Before the Raise |

After the Raise |

After the Raise |

| Debt | $100,000 | $100,000 | $120,000 |

|

Income |

$1000 |

$1200 |

$1200 |

|

Mortgage |

-$537 |

-$537 |

-$537 |

|

Expenses |

-$500 |

-$500 |

-$500 |

|

Car |

$0 |

$0 |

-$200 |

|

Net |

-$37 |

$163 |

-$37 |

As you can see, although we decided buy a car, we are still “deficit neutralâ€. Our income has gone up, but our incremental losses each month have not.

But what happens 5 years down the line?

| Saved the Money | Bought the Car | Never even got the Raise | |

| Total Debt | -$85,314 | -$99,981 | -$85,314 |

| Cash in the Bank | $9,780 | -$2,982 | $-2,982 |

After time passes, we now see that “deficit neutral†does not mean we didn’t create a more dire financial picture. Sure, we are now the proud owners of a 5 year old car. But to do so, we’ve amassed 17% more debt, and have nothing in the bank. Ironically, of the 3 financial outcomes, you can easily argue that we would be better off to never even get the raise than to buy the car. Can you imagine saying to your boss, “Please don’t give me a raise – it will send me into more debt!�

Finally, how often do you get a large raise? Can the government give itself a raise any time it wants to? The answer is – not very often. Sure, the government can give itself a raise by way of more taxes, each time we do so, we decrease economic growth. As such, the government needs to choose very wisely when it does tax and for what purpose. By having increased our taxes to pay for healthcare, Obama will need to raise even more taxes to pay off our debt.

So now the question is – what is Obama’s plan to get to financial responsibility? He seems to think “deficit neutral†is responsible. But, as you can see, that’s not the whole picture. I know this is obvious to most readers of this blog – sorry for being pedantic.

** The numbers above are all based on values I picked for interest, periods, etc. I chose reasonable numbers – 5% interest, a little more for the car, only 10% for credit card debt, etc. This was just the first set of numbers I used. Regardless of the numbers you use, realistic-ish scenarios yield similar results.